Fed Meeting: Could a 50 Basis Point Cut Be on the Horizon?

The Federal Reserve's meeting on this month has the real estate market buzzing with optimism. While most experts anticipate a 25 basis point (0.25%) rate cut—or none at all—some voices are suggesting that a more substantial 50 basis point (0.50%) cut may be necessary to stimulate much needed economic growth.

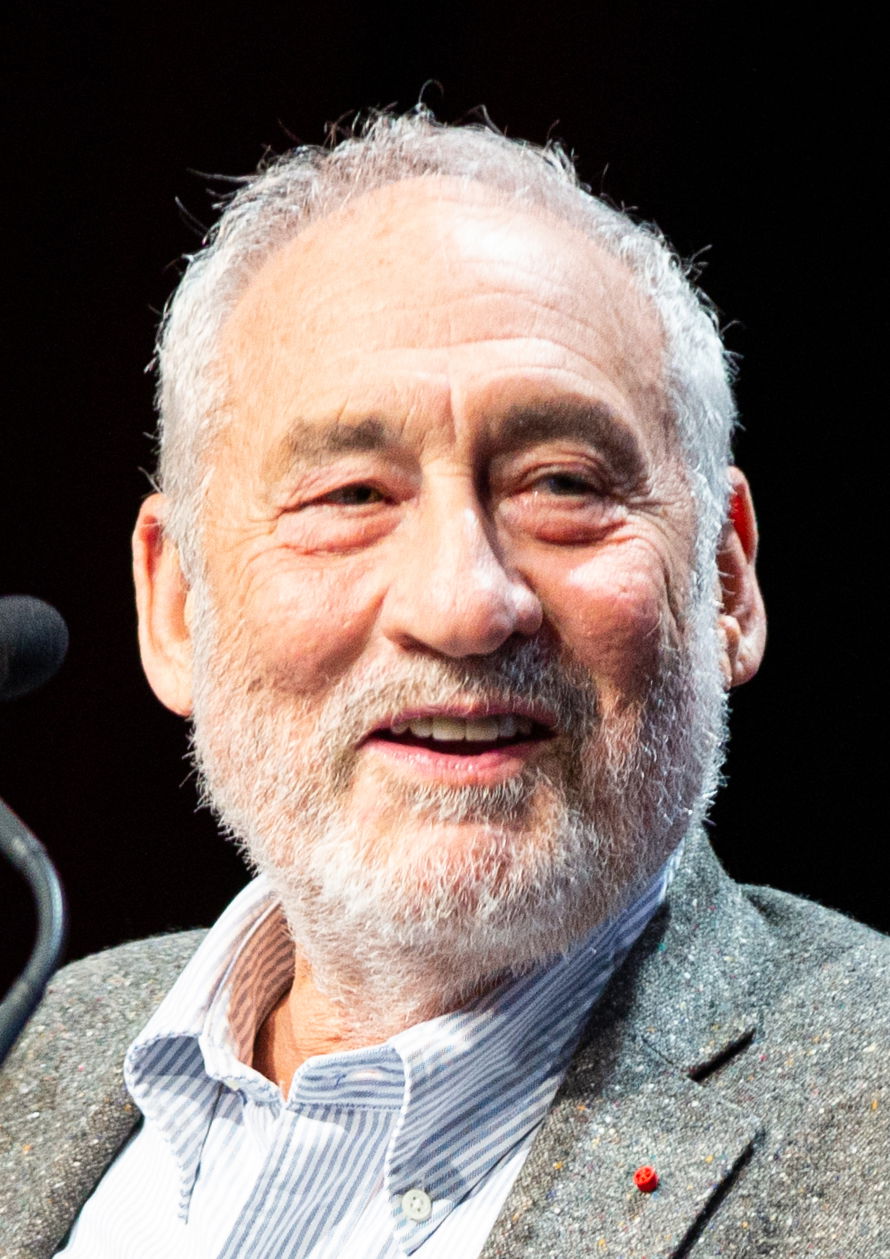

Nobel Prize-winning economist Joseph Stiglitz believes the Federal Reserve should deliver a half-point interest rate cut, and if fact he believes it is well overdue. He's quoted accusing the U.S. central bank of going "too far, too fast" with monetary policy tightening and worsening inflation.

A significant cut could lower borrowing costs, potentially boosting buyer activity and easing some pressure on the housing market and inflation. However, any decision by the Fed will depend on the latest economic data and their outlook on inflation. While unemployment continues to increase, we need to see the Fed commit to a rate cut. The Fed stated they expected 4 total cuts in 2024, and we have yet to see them solve the current inflation issues that our nation faces.

All eyes will be on this meeting to see if the Fed takes a more aggressive stance or let's consumers try to figure it out on their own.

*Joseph Stiglitz, Noble Prize Economist